Long-term bank loans and support from international financial institutions, bond issues, government subsidies and public-private partnerships are helping to accelerating infrastructure project financing , the recovery of the global economy from the protracted crisis.

The growth of the economy is based on the development of the transport network, therefore, effective financing of infrastructure projects plays a key role in modern business.

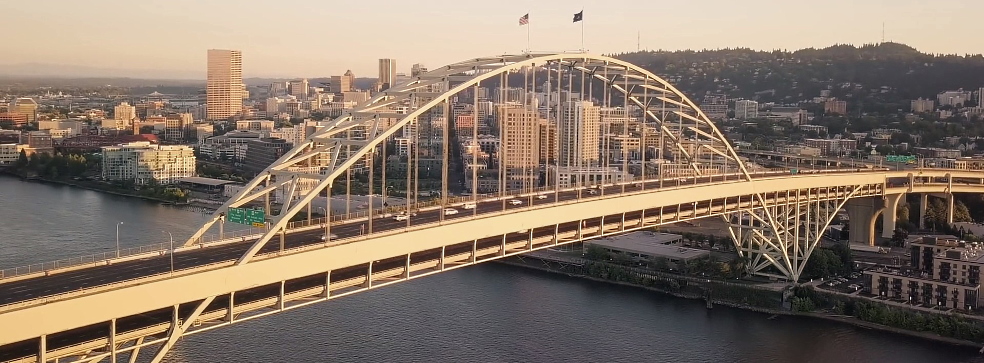

An increase in the quality and density of roads increases the productivity of all sectors of the economy that use it.

Viola Funding Limited offers advanced financial solutions for Infrastructure project financing as roads, and other transport infrastructure around the world.

Among our clients are large private companies and government customers who achieve their goals thanks to flexible financial instruments and qualified services offered by Viola Funding team

Sources of financing for infrastructure projects

To searching for Infrastructure project financing ,it is important for companies to understand the source that affect the investment decision:

• Terms of obtaining funding in the required amount.

• The impact of a specific source on the timing of the project and its individual stages.

The construction of roads and bridges usually requires significant capital investments in a short time frame of about 1-2 years.

The practice of our financial team shows that there is no single right decision when choosing a source of financing for infrastructure projects. Each project requires a unique set of tools to attract the right resources in line with the investment spending schedule and debt service capabilities.

The advantages and disadvantages of different sources of funding for road infrastructure are described in more detail below. If you are looking for a long-term loan for the construction and modernization of infrastructure, contact the financial team of VIOLA FUNDING LIMITED.

We offer our partners large loans from 50 million euros for up to 20 years, providing comprehensive support in the implementation of large projects around the world.

Loans from international financial institutions

In addition, international banks can provide advice at the stage of project preparation, sharing their experience and knowledge. The reputation of such large partners helps to increase the investment attractiveness of projects, opening up ample opportunities for companies to raise capital from alternative sources.

The procedure for monitoring an investment project in the case of international financial institutions is usually comparable to that used by commercial banks.

It is also important to take into account the specific conditions for the provision of financing, which in many cases differ. Organizations targeting the development of key projects in developing countries strive to rationally allocate financial resources. For this reason, the World Bank, for example, does not provide loans for projects that could be financed commercially.

Stages of Infrastructure project financing through international loans:

1. Making a decision on the allocation of financial resources.

2. Signing a loan agreement.

2. Implementation of the infrastructure project.

3. Control and monitoring.

4. Payment of debt.

If you need assistance in providing an international loan for the construction of infrastructure, please contact representatives for advice.

The World Bank and its structures will require the provision of government guarantees for the loan. In addition, international financial institutions usually set restrictions on their participation in a particular project.

The European Investment Bank will finance no more than 50% of the project cost, but some institutions may limit their participation to even smaller shares.

Financing road construction through bond issues

Funding conditions, including discount and interest on bonds issued, are determined primarily by market conditions. When it comes to attractive investment projects, the issuer has more freedom in determining the terms of financing. However, the terms of redemption of bonds cannot be changed after the placement of securities, unlike the terms of a bank loan.

The bond issuer, which is usually a public sector company, must have a high credit rating to demonstrate its solvency and financial soundness. This is especially important if the issuer plans to place securities on international financial markets outside of his country.

Public offering of bonds on international capital markets involves additional formal procedures that take up the time and energy of your employees, not allowing you to fully focus on key business areas.

Stages of Infrastructure project financing by issuing bonds:

• Issue and placement of securities.

• Implementation of the project.

The issue of bonds is a rather complex legal procedure that requires control over the issuer’s finances and may even require participation in marketing activities.

Be that as it may, infrastructure projects financed through the issue of bonds should provide potential investors with confidence in the payment of debt.

Public offering of bonds on international capital markets involves additional formal procedures that take up the time and energy of your employees, not allowing you to fully focus on key business areas.

Financing infrastructure projects from local budgets

In fact, the initiators of the project will not need to develop complex procedures for debt recovery and servicing financial flows. Although the initial cost of raising and using budget funds is low, this choice can lead to the loss of the potential benefits of other sources of funding.

Most governments today seek to shift financial responsibility for infrastructure to private capital, thereby reducing budget deficits and saving money for more important projects.

It is also necessary to take into account the factor of corruption, which has a significant impact on the implementation of capital-intensive projects in some countries. This unpredictable factor can undermine financial plans and increase the cost of projects.

The amount of funding and the possibility of its provision directly depends on the budget of a particular region.

The policy on financing infrastructure projects in each country is limited by legislation, so some projects cannot count on this source of financing in principle.

Additional problems associated with infrastructure project financing by state bodies arise due to the numerous contradictions in cooperation between various parts of the administration.

The risks associated with the lack of coordination of regional authorities are especially high in developing countries.

It is also necessary to expand the circle of interested private companies (suppliers, contractors) for the effective implementation of the project.

Viola funding Limited is ready to finance the construction of almost any facility in most countries of the world.

If you are looking for a reliable private partner who has been investing in road infrastructure for many years, contact our specialists. With us you will find advanced solutions to the most ambitious technical and financial challenges.

eMAIL:[email protected]

Website:https://viola-funding.com/