Recent events have spurred the development of the e-commerce industry, while simultaneously hitting tourism, airlines and some real estate markets in traditionally expensive regions of the world. On the one hand, the crisis is costing the global economy trillions of dollars annually. On the other hand, the pandemic is accelerating technological change, innovative business processes and economic transformations that have actually been on the table for many years. Each Financial investment and economic crisis brings unique investment opportunities, such as buying stocks cheaply on the stock exchange, reduced construction prices, or taking over assets of bankrupt businesses.

Covid-19 pandemic isn’t the final test for financial investment and economic crisis, companies must learn to be supple in investment policy.

There are many alternatives for business. As it becomes more difficult to find attractive forms of investment in the financial markets, interesting prospects have emerged in real estate and the construction industry working for it. Companies that invest correctly in affected industries or discover promising horizons for the future will undoubtedly be in the black.

Viola Funding Limited, has assembled a team of highly qualified investment and project finance professionals.

We offer long-term loans, support investment projects and provide a wide range of advisory services in the energy, mining, industry, agriculture, real estate and tourism sectors around the world.

Financial investment market and economic elements

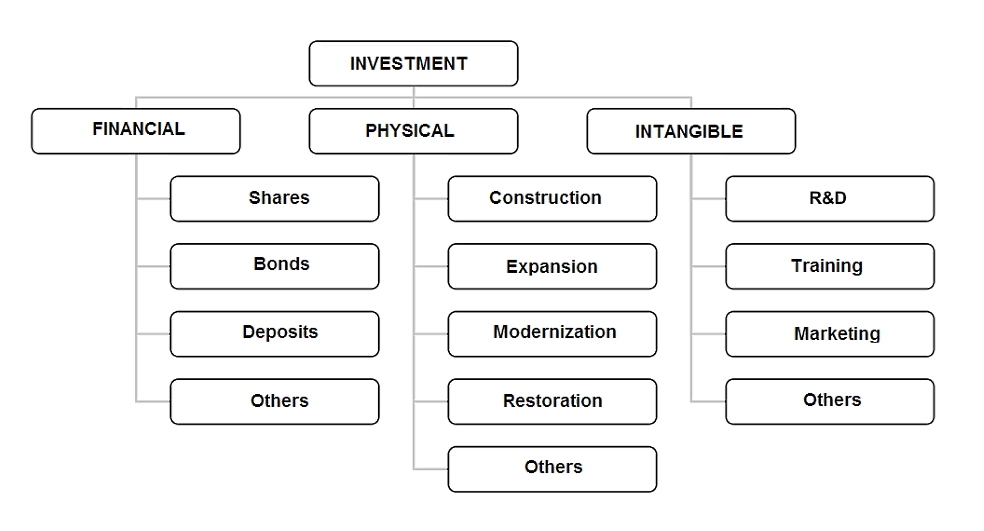

The range of instruments currently available to investors for investing financial surpluses is very wide.

On the other hand, low interest rates and the loss of part or all of the accrued interest in the event of early closure of the deposit are considered serious drawbacks of bank deposits.

However, in the case of structured financial products, the question is not how much the investor will receive under certain conditions.

Structured financial products are an attractive tool for carrying out investment activities of a business during a crisis. From the point of view of investors, they can be a good alternative to both deposits and physical investments. However, success in this area requires a deep understanding of the essence of this tool and the rational distribution of risks.

Depending on the choice of the debt instrument, the investor strikes a balance between profitability and safety.

However, investing in stocks is fraught with the threat of loss of funds, which is not well received by the investment community during the financial crisis. In this case, stock prices do not reflect the real value of the business and are the result of speculative play.

In practice, there are other investment opportunities in the financial markets. Investing in investment funds (including venture capital), currency speculation, buying art, antiques, wine, investing in various indices (securities, commodities) and a wide range of other derivatives offer the investor a valuable alternative to physical investment.

Benefits of financial investments for business

Investment projects are the main tool for creating and improving the production / service potential of the company. This helps the company to meet market expectations and at the same time provides a significant competitive advantage in the period of the subsequent return of the economy to an upward trend.

The investment activity of a business during a crisis is not only an opportunity for dynamic development, but also often an important condition for the survival of each economic unit.

It is important that during an economic crisis investment costs are usually lower than during a period of dynamic economic growth.

Technologies, materials, and labor in general are cheaper compared to the period when many economic entities compete for them.

There is an opinion that investments in financial markets do better for this purpose.

Physical investments: the essence of the investment process

Thus, the main purpose of investment is to obtain a certain competitive advantage by the enterprise or to prevent the loss of its position in the market.

Also, financial experts identify “replacement” investments aimed at maintaining the existing production capacity, undertaken in order to maintain the company’s activities at the current level and maintain a competitive position.

Researchers also highlight strategic investments aimed at protecting the company from adverse conditions, enhancing the company’s development in strategically important directions and entering new markets.

In the contemporary financial investment and economic crisis , the goal is not to maximize value for capital owners, but to meet the standards required by law and the market.

Experts classify real investment projects by their duration:

• Short-term investments: implementation period up to 3 months, life cycle up to 5 years.

• Medium-term investments: implementation period up to a year, life cycle from 5 to 10 years.

Physical investments are most often carried out with a long-term expectation, therefore, due diligence must be exercised in planning investment costs and sources of their financing, as well as in forecasting financial and economic effects in the future.

The time and cost of liquidating a project may vary.

Fiscal policy, the situation on the capital market, the level of interest rates, exchange rate volatility, changes in supply and demand, environmental regulations, labor regulations are just the most important macroeconomic factors affecting the investment activity of a business.

Business investment activity during the crisis

It would seem that during the economic crisis, investments are the main condition for the successful development and competitiveness of the company.

According to many experts, the period of economic crisis is the best time for large investments.

During a crisis, capital costs are usually lower than during periods of economic growth and higher resource prices.

It also becomes much cheaper to acquire companies and take over a ready-made business, the cost of which is definitely lower.

In general, any investment activity is primarily aimed at protecting and increasing capital.

An example is investing in securities, building large facilities, or acquiring promising companies early in the life cycle in order to generate high profits in the future.

Viola Funding Limited offers corporate clients a full range of financial and legal services related to investment activities.

Our professional team has helped many companies to implement investment projects in Europe, USA, Latin America, North Africa, the Middle East and other regions of the world. Contact us for details.

eMAIL:[email protected]

Website:https://viola-funding.com/