Infrastructure development is now a priority for the world’s leading economies. The state and quality of infrastructure is one of the criteria for socio-economic development and a powerful lever for the growth of social welfare. Energy, water supply, transport and telecommunications directly affect the quality of life of the population. Loans for large infrastructure projects Financing creates stable jobs and spurs growth in other sectors of the economy.

One of the most important models for financing new infrastructure projects is project finance

Financing and management of the project is carried out through a special purpose vehicle (SPV), the shareholders of which are companies interested in the project.

With the growing need for financing large infrastructure projects, dissatisfaction with the current quality of infrastructure and limited resources of the state budget, the PF is becoming an increasingly important instrument that meets the interests of business and society.

Viola Funding Limited offers loans for large infrastructure projects and the construction of wind farm plants and other facilities.

Our underwriting teams can you obtain large loans from our high-net-worth Angel investor’s. We also offer clients all kinds of financial advice, tax optimization and other services.

The essence of infrastructure projects

Financing infrastructure projects often requires public participation. In Europe, the importance of this issue is emphasized through co-financing from the European budget.

Infrastructure investments can be classified according to the source of funds. Here we are talking about public, private and public-private investments made jointly by both sectors.

Funding models for infrastructure projects should take into account capital intensity, high risk and long investment project cycle.

This limits the financing options available, and sometimes excludes the participation of a private investor who expects a return on capital invested in the shortest possible time.

Fundamentals of financing large infrastructure projects

Against this background, the search for funds to finance large infrastructure projects has intensified, since business is looking for the most convenient and profitable sources both in the form of investment loans and in the form of combined PF instruments.

Private equity in financing infrastructure projects

In most of the EU countries, the provision of infrastructure services is still the responsibility of municipalities, which determines their key role in such projects.

Despite the current significant differences between the management of public and private entities, in both cases the goal is to improve efficiency and increase the value of the company.

It should be borne in mind that the traditional management of infrastructure and the provision of public services by state-owned companies has become ineffective.

Infrastructure service models

Currently, there are different approaches regarding the allocation of costs, risk and, as a result, the sharing of rewards. We can distinguish four models in the provision of infrastructure services.

Finally, the industrial model is appropriate when a company that owns an infrastructure wants to improve its functioning. Local government policies also play an important role in this matter.

Investment loan for large infrastructure construction

An investment loan is a type of loan provided to companies to finance new investment projects. This type of financing is characterized by a significant amount of available funds.

To obtain an investment loan for the construction of infrastructure, a company usually needs to make a contribution of up to 20-30% of the total planned investment costs.

Investment loans for businesses can be provided for up to 15-20 years. This option has a number of significant advantages. First, the company can repay the loan before the agreed period expires. Secondly, banks can provide grace periods.

New opportunities for infrastructure projects

As already mentioned, PF is a method of financing capital-intensive, usually long-term investment projects. This fully applies to infrastructure projects. Savings on the scale of the project, capital intensity, long construction period – these features force investors to use project finance tools.

The use of high leverage means the need to provide appropriate securities to guarantee creditors debt repayment.

Our funding services in Europe and beyond

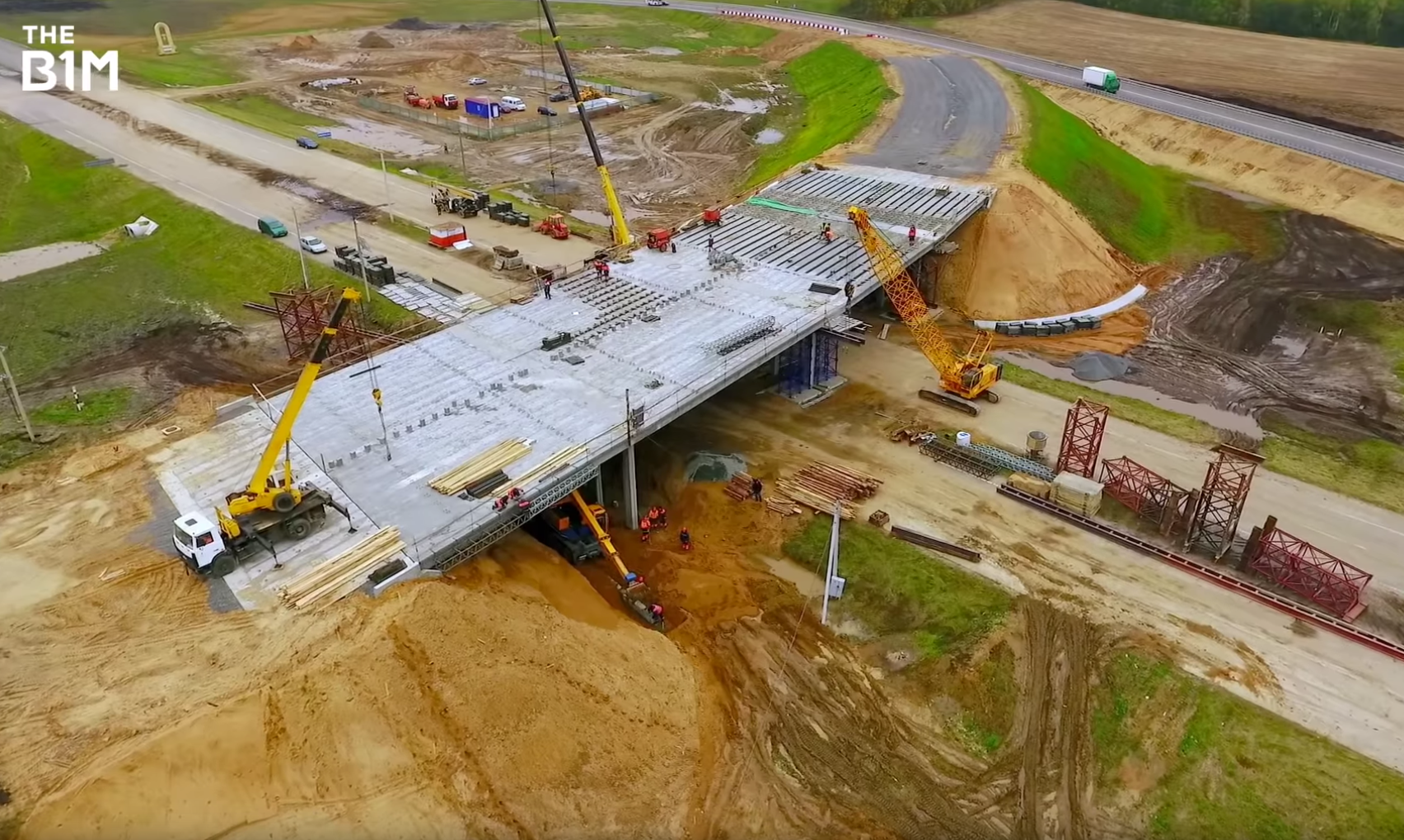

Viola Funding Limited provides a full range of financial services related to the construction, modernization or expansion of infrastructure around the world. We offer financing for large infrastructure projects of all types.

eMAIL:[email protected]

Website:https://viola-funding.com/